Maximize Your Savings: 10 Essential Tips for Filing Income Tax in Singapore

Introduction: Are you looking for tips to maximize your savings while filing income tax in Singapore? Well, you’ve come to the right place! I’ve done some research on this topic and I’m here to share with you 10 essential tips that will help you save more money while filing your income tax in Singapore.

Before we dive into the tips, let’s first understand why it’s important to maximize your savings while filing income tax in Singapore. Income tax can take up a significant portion of your income, especially if you’re a high earner. By following these tips, you can reduce your taxable income, increase your tax deductions, and ultimately save more money.

Table of Contents

- Tip 1: Claim Rental Expenses

- Tip 2: Donate Money, Shares or Other Items

- Tip 3: Know the Income Tax Relief Ceiling

- Tip 4: Understand Tax Residency

- Tip 5: Familiarize Yourself with Taxable and Non-taxable Income

- Tip 6: Be Aware of Deductible Expenses

- Tip 10: Seek Professional Help When Needed

- Meanwhile, Check Out Tropika Club’s Ecosystem of Websites

Tip 1: Claim Rental Expenses

Rental Expenses

Claim If you own a property that you rent out, you may be able to claim certain expenses related to that rental property on your tax return. These expenses can include repairs, maintenance, and even property taxes.

Calculation of Rental Expenses Claim

To calculate the amount of rental expenses you can claim, you’ll need to add up all the eligible expenses and subtract them from your rental income. You can also deduct the interest on your home loan. The total amount you can claim is 15% of your rental income plus the home loan interest.

Conditions for Claiming Rental Expenses

To claim rental expenses, there are certain conditions that must be met. For example, the property must be rented out for income-generating purposes, and you must keep proper records and receipts to support your claim. Make sure to consult with a tax professional or visit the official government website for more information on the specific conditions for claiming rental expenses.

Tip 2: Donate Money, Shares or Other Items

Donating and Its Tax Benefits

Donating money, shares, or other items to a charity or non-profit organization can not only help those in need, but can also provide tax benefits for the donor. The tax benefits depend on the value of the donation and can be quite substantial.

Calculation of Tax Benefits: 250% of Donation Value

In Singapore, donations to approved institutions can qualify for a tax deduction of 2.5 times the amount donated. This means that if you donate $100, you can claim a tax deduction of $250 [1].

Conditions for Donating

To claim a tax deduction for your donation, there are certain conditions that must be met. For example, the charity or non-profit organization must be approved by the government, and you must have a receipt or other documentation to support your claim.

How to Donate and Claim Tax Benefits

To donate and claim tax benefits, start by finding an approved institution that aligns with your values and beliefs. You can then make your donation directly to the institution, and make sure to obtain a receipt or other documentation as proof of your donation. When filing your taxes, you can then claim the tax deduction using the appropriate form and attaching your receipt or documentation.

Tip 3: Know the Income Tax Relief Ceiling

Income Tax Relief Ceiling

The Income Tax Relief Ceiling refers to the maximum amount of tax relief that a taxpayer can claim in a given year. This relief is meant to help offset taxable income and reduce the amount of taxes owed.

Calculation of Income Tax Relief Ceiling: $80,000

In Singapore, the current Income Tax Relief Ceiling is $80,000 per year. This means that you can claim up to $80,000 in tax relief for the year, provided you meet the necessary conditions.

Conditions for Obtaining Maximum Relief

To obtain the maximum relief of $80,000, you will need to make certain contributions, such as contributing to your Central Provident Fund (CPF) account or making donations to approved charities. You will also need to meet other conditions, such as being a tax resident of Singapore and having sufficient income to claim the relief.

Tips to Maximize Income Tax Relief

To maximize your income tax relief, make sure to plan ahead and take advantage of all the available tax deductions and reliefs. This may include contributions to your CPF account, making donations to approved charities, or investing in certain approved products. You can also consult with a tax professional for more personalized advice on how to maximize your income tax relief.

Remember, understanding the Income Tax Relief Ceiling and how to maximize your tax relief can help you reduce your tax burden and save money. So, make sure to do your research and take advantage of all the available tax deductions and reliefs.

Tip 4: Understand Tax Residency

Tax Residency

Tax residency refers to the country where you are considered a tax resident for the purposes of filing taxes. In Singapore, tax residency is determined by various factors, such as the length of stay in the country and the purpose of stay.

Conditions for Tax Residency

To be considered a tax resident in Singapore, you must meet certain conditions, such as staying in the country for at least 183 days in a year or having a permanent home in Singapore [1].

How to Determine Tax Residency

To determine your tax residency status in Singapore, you can refer to the guidelines provided by the Inland Revenue Authority of Singapore (IRAS). The guidelines take into account various factors, such as your employment status, length of stay, and ties to Singapore. You can also consult with a tax professional for personalized advice on your tax residency status.

Understanding your tax residency status is important for filing your taxes correctly and avoiding penalties. So, make sure to do your research and determine your tax residency status before filing your taxes in Singapore.

Tip 5: Familiarize Yourself with Taxable and Non-taxable Income

Taxable and Non-taxable Income

Taxable income refers to any income that is subject to taxation by the government. This can include salaries, bonuses, rental income, and capital gains, among other types of income. Non-taxable income, on the other hand, refers to income that is not subject to taxation. This can include certain types of government benefits, gifts, and inheritances.

Examples of Taxable and Non-taxable Income

To better understand taxable and non-taxable income, here are some examples:

Taxable Income

- Salaries and wages

- Bonuses and commissions

- Rental income

- Capital gains

- Dividends

Non-taxable Income

- Gifts and inheritances

- Scholarships and bursaries

- Government benefits, such as GST Voucher and Workfare Income Supplement

- Life insurance payouts

It’s important to familiarize yourself with the different types of taxable and non-taxable income, as this will affect your tax liability and the amount of taxes you owe. If you have any questions or concerns about your taxable and non-taxable income, you can consult with a tax professional for personalized advice.

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)

Tip 6: Be Aware of Deductible Expenses

Deductible Expenses

Deductible expenses refer to expenses that can be subtracted from your taxable income, thus reducing the amount of taxes you owe. These expenses can include a variety of items, such as charitable donations, medical expenses, and business expenses.

Examples of Deductible Expenses

To better understand deductible expenses, here are some examples:

Charitable Donations

Donations to approved charities can be claimed as deductible expenses. This includes cash donations, as well as donations of goods or services.

Medical Expenses

Certain medical expenses, such as doctor’s fees, hospital bills, and prescription medications, can be claimed as deductible expenses. However, there are certain conditions that must be met, such as the expenses being incurred for yourself, your spouse, or your children.

Business Expenses

If you are self-employed or own a business, you can claim certain business expenses as deductible expenses. This can include expenses such as rent, utilities, and office supplies.

Conditions for Claiming Deductible Expenses

To claim deductible expenses, you must meet certain conditions, such as keeping proper records and receipts of the expenses. You must also ensure that the expenses are incurred for the purposes of earning income, and that they are not personal or capital expenses.

It’s important to be aware of deductible expenses, as they can help you reduce your tax liability and save money. If you have any questions or concerns about deductible expenses, you can consult with a tax professional for personalized advice.

_

Read Also:

6 Things Everyone Gets Wrong About Cats

_

Tip 7: Know the Different Tax Reliefs Available

Different Tax Reliefs

Tax reliefs are measures put in place by the government to help reduce the tax burden on certain individuals or groups. There are several types of tax reliefs available, such as personal reliefs, spouse reliefs, and parent reliefs.

Examples of Different Tax Reliefs

To better understand the different tax reliefs available, here are some examples:

Personal Reliefs

Personal reliefs are available to all taxpayers, and can be used to reduce your taxable income. This includes reliefs for education expenses, donations to approved charities, and insurance premiums.

Spouse Reliefs

Spouse reliefs are available to married couples, and can be used to reduce the tax liability of the couple. This includes reliefs for supporting a non-working spouse, as well as reliefs for paying for your spouse’s medical expenses.

Parent Reliefs

Parent reliefs are available to taxpayers who are supporting their parents financially. This includes reliefs for supporting aged parents, as well as reliefs for paying for your parent’s medical expenses.

Conditions for Obtaining Tax Reliefs

To obtain tax reliefs, you must meet certain conditions, such as being a Singapore tax resident and meeting the specific requirements for each type of relief. Some reliefs may also have maximum limits, so it’s important to be aware of these when planning your tax strategy.

Knowing the different tax reliefs available can help you maximize your tax savings and reduce your tax liability. If you have any questions or concerns about tax reliefs, you can consult with a tax professional for personalized advice.

Tip 8: Keep Track of Your Tax Filing Deadlines

Tax Filing Deadlines

Tax filing deadlines are the dates by which you must file your income tax returns with the tax authorities. In Singapore, the tax filing deadline for individuals is typically April 15th of each year.

Penalties for Late Filing

Failing to file your tax returns by the deadline can result in penalties and fines. The penalty for late filing is $100 for each month the return is late, up to a maximum of $1,000. In addition, you may also be charged interest on any tax payable that is not paid by the deadline.

Tips to Avoid Late Filing

To avoid late filing penalties and fines, it’s important to keep track of your tax filing deadlines and plan ahead. Here are some tips to help you stay on top of your tax obligations:

- Mark your calendar with the tax filing deadline and set reminders to ensure you don’t miss it.

- Start preparing your tax returns early to give yourself enough time to gather all necessary documents and information.

- Consider using tax software or hiring a tax professional to help you prepare and file your returns.

- If you need more time to file, you can request an extension from the tax authorities, but be aware that this does not extend the deadline for payment of any taxes owed.

By keeping track of your tax filing deadlines and planning ahead, you can avoid late filing penalties and stay in good standing with the tax authorities.

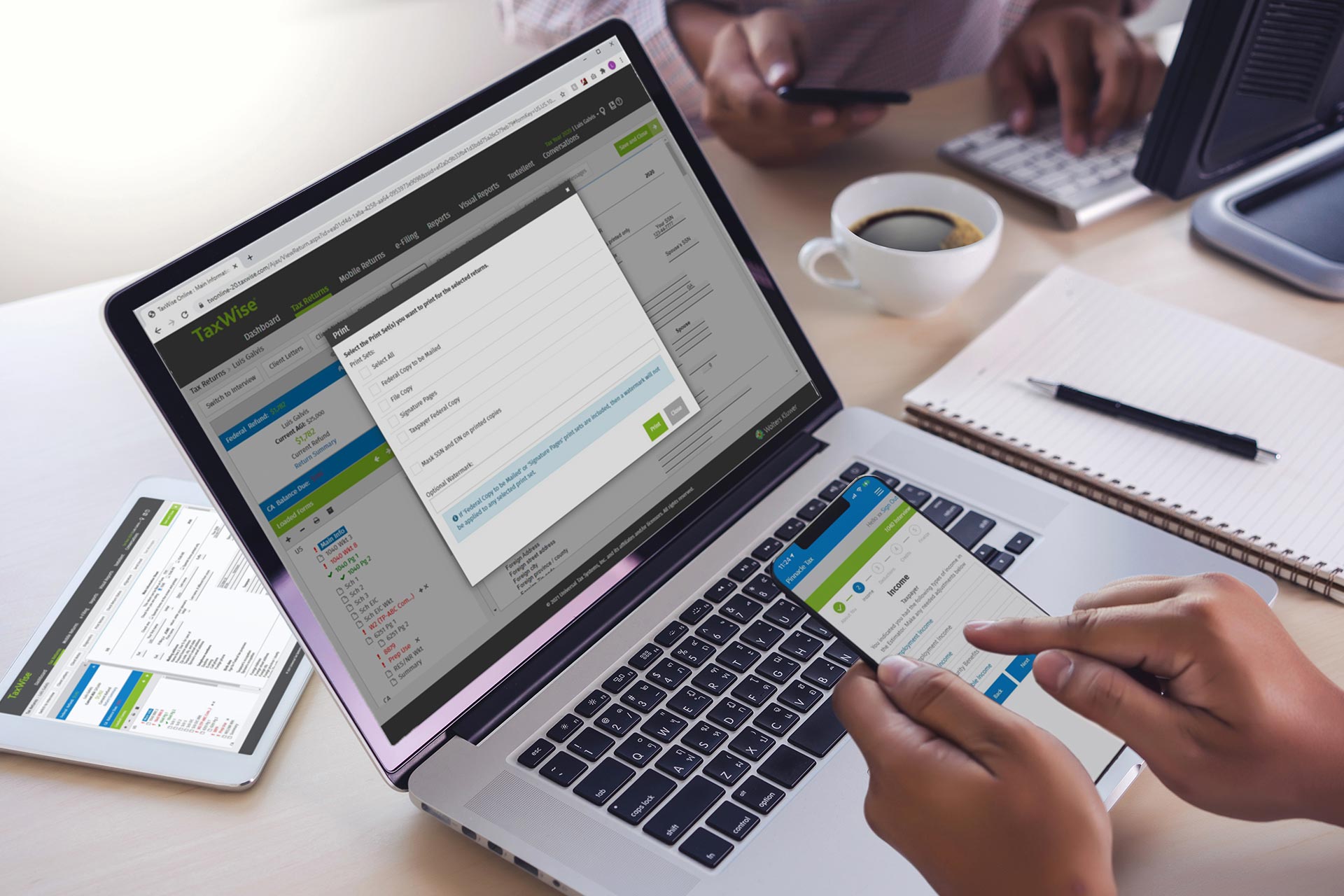

Tip 9: Utilize Tax Filing Software and Resources

Tax filing can be a daunting task, but there are many software and resources available to make it easier. Tax filing software like TurboTax and H&R Block can guide you through the process step by step and ensure that you don’t miss any important deductions. You can also use online tax calculators and checklists to make sure you have all the necessary information and documents. Some resources even offer free tax filing for low-income individuals. The advantages of using tax filing software and resources include greater accuracy, faster processing times, and a higher likelihood of claiming all the deductions and credits you’re entitled to. So why not take advantage of these tools and resources to make your tax filing experience smoother and more efficient?

Tip 10: Seek Professional Help When Needed

Seeking professional help with your taxes can be a smart move if you’re feeling overwhelmed or unsure about the process. Tax professionals, such as accountants or tax preparers, can offer valuable expertise and guidance to help you navigate the complex tax system. They can also help you identify potential deductions or credits that you may have missed on your own. While hiring a professional may come with a cost, the potential benefits can outweigh the expense. Just be sure to do your research and choose a reputable professional who has experience in the areas you need help with. Don’t be afraid to ask for referrals or to check reviews before making your decision.

Conclusion

In conclusion, filing income tax in Singapore can be a complex process, but with these 10 essential tips, individuals can maximize their savings and minimize their tax liabilities. From claiming rental expenses and donating to understanding the income tax relief ceiling, tax residency, taxable and non-taxable income, deductible expenses, and different tax reliefs, to keeping track of tax filing deadlines, utilizing tax filing software and resources, and seeking professional help when needed, individuals can effectively file their income tax returns and save money for the future. One important tip to keep in mind is to make saving automatic, as waiting until the end of the month to save may result in having little to no money left to save [1]. By following these essential tips, individuals can take control of their finances and secure a better future for themselves and their families.

Have an Article to Suggest?

Tropika Club is always looking for new and exciting content to feature in their magazine and they value the input of our readers. If you have any noteworthy content or articles that you believe would be a great addition to Tropika Club’s magazine, we are open to suggestions and encourage you to reach out to us via email at [email protected]. By doing so, Tropika Club values your expertise and knowledge in the matter and appreciates your willingness to help. We will review your recommendations and update our list accordingly

Meanwhile, Check Out Tropika Club’s Ecosystem of Websites

Tropika Club Magazine – Tropika Club Magazine is a Singapore-based publication that features articles on a wide range of topics with a focus on local businesses and content for the region. The magazine emphasizes supporting local businesses through its #SupportLocal initiative, which includes coverage of everything from neighborhood hawker stalls to aesthetic clinics in town. In addition to highlighting local businesses, Tropika Club Magazine also covers a variety of local content, including beauty, lifestyle, places, eats, and what’s on in Singapore and the Asia Pacific region.

Tropika Club Deals – Tropika Club Deals is a leading online deals and voucher shopping site in Singapore, offering amazing discounts on beauty, wellness, and fitness products and services. It’s the perfect platform for customers who want to discover the best deals without having to commit to a specific appointment date and time. These deals are available at major beauty stores, facial salons, hair salons, and other brands in Singapore, with no minimum spend required. Choose from guaranteed discounted deals in the categories of hairstyling, hair removal, facial & aesthetics, body slimming, brows & lashes, nails & makeup, massage & spa or fitness & wellness. Tropika Club Deals is also ideal for customers who want to buy vouchers as gifts or to use for the future. So whether you’re looking to save money on your next haircut or want to treat yourself to a relaxing massage, Tropika Club Deals has got you covered with the best voucher and coupon deals in Singapore!