10 Things You Didn’t Know about PayNow

No Time to Read? Here’s a Snappy Summary of This Article

- Instant Transfers: PayNow enables lightning-fast transactions, ensuring your money reaches its destination almost instantly, 24/7.

- Universal Accessibility: Access PayNow conveniently across different banks, fostering seamless financial transactions between users, regardless of their banking institutions.

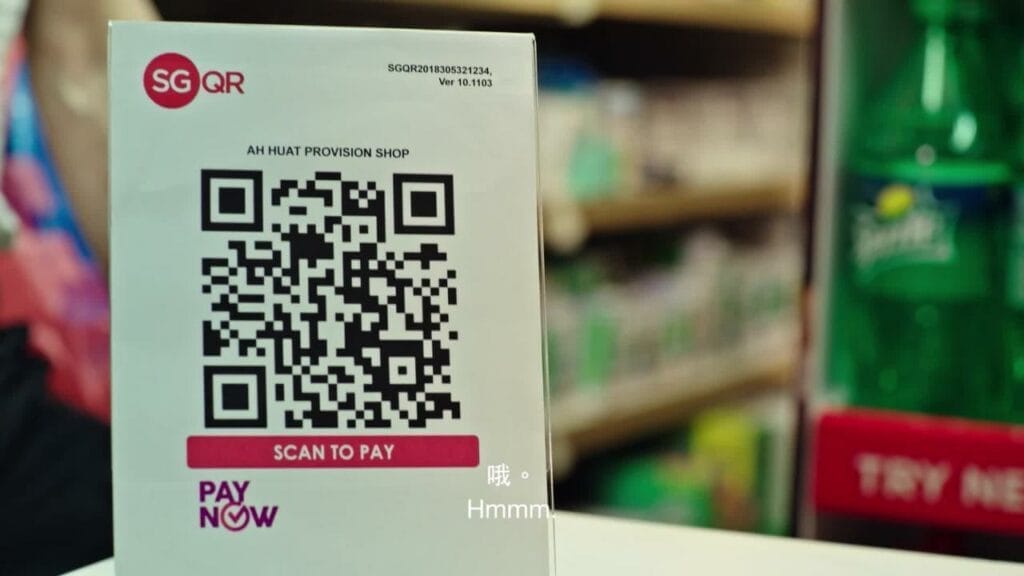

- QR Code Magic: Simplify transactions by scanning QR codes. PayNow harnesses the power of QR technology, making payments quick and effortless.

- Mobile Number Miracles: Bid farewell to long account numbers. With PayNow, you can send money using just the recipient’s mobile number.

- Bill Payments Made Easy: Forget the hassle of traditional bill payments. PayNow streamlines the process, allowing you to settle bills with remarkable ease.

- Financial Inclusion: PayNow promotes financial inclusivity by providing a user-friendly platform that caters to diverse individuals, fostering a more connected and accessible financial landscape.

Table of Contents

- No Time to Read? Here’s a Snappy Summary of This Article

- 1. The Origins of PayNow

- 2. Not Just for Individuals

- 3. QR Code Magic

- 4. Security Measures

- 5. Instant Transfers

- 6. Multi-Bank Support

- 7. No Fees Attached

- 8. Transaction History

- 9. Linking Multiple Accounts

- 10. Future Developments

- Meanwhile, Check Out Tropika Club’s Ecosystem of Websites

Introduction

In the bustling streets of Singapore, where time is money and convenience is king, PayNow has emerged as a game-changer in the digital payment landscape. Gone are the days of fumbling for cash or waiting for card transactions to process. With a simple scan or a few taps on your smartphone, you can pay for anything from hawker food to high-end gadgets. But how much do you really know about this ubiquitous payment system? Buckle up as we delve into 10 surprising facts about PayNow that will make you see this everyday tool in a whole new light.

1. The Origins of PayNow

PayNow wasn’t just a random initiative; it was a strategic move by the Monetary Authority of Singapore (MAS) and the Association of Banks in Singapore (ABS) to accelerate the nation’s journey towards a Smart Nation. Launched in 2017, the platform aimed to simplify peer-to-peer transactions and reduce the reliance on physical cash. It was an instant hit, and its adoption rate soared, making it a staple in the financial diet of many Singaporeans.

2. Not Just for Individuals

While many people associate PayNow with personal transactions, the platform has expanded its services to include businesses, government agencies, and even non-profit organizations. This means you can pay your taxes, make donations, and even handle business invoices, all through PayNow. This versatility has made it an integral part of Singapore’s digital economy.

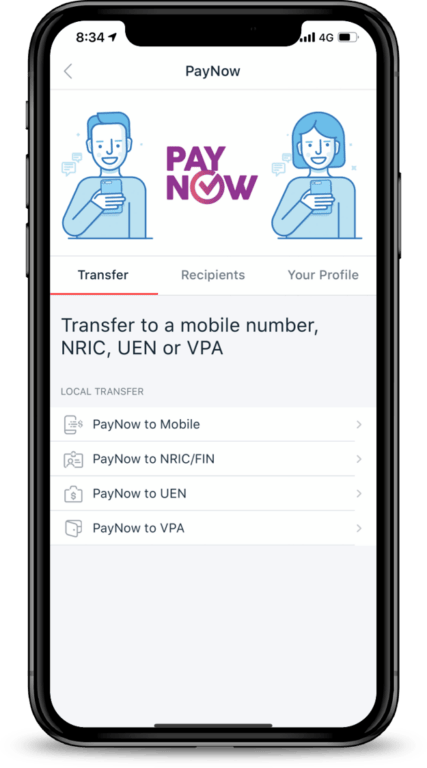

3. QR Code Magic

One of the most convenient features of PayNow is its QR code functionality. Instead of manually entering account numbers or mobile numbers, users can simply scan a QR code to initiate a transaction. This feature is especially handy for businesses, as it eliminates the need for costly point-of-sale systems and streamlines the payment process.

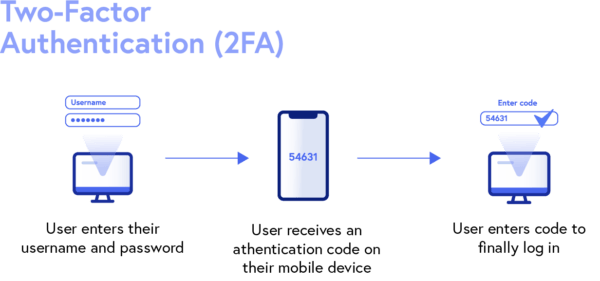

4. Security Measures

PayNow takes security seriously. The platform uses two-factor authentication (2FA) and encryption technologies to ensure that your transactions are secure. Additionally, the system has a transaction limit to prevent large unauthorized transactions, providing an extra layer of security.

5. Instant Transfers

One of the biggest selling points of PayNow is its real-time transaction capability. Unlike traditional bank transfers that can take up to several days, PayNow transactions are almost instantaneous. This speed is crucial for businesses that rely on quick payments and for individuals who can’t afford to wait.

6. Multi-Bank Support

PayNow is not limited to a single bank. It supports multiple banks in Singapore, making it incredibly versatile. Whether you have an account with DBS, OCBC, or UOB, you can use PayNow. This interoperability is a significant advantage over other payment methods that are restricted to specific banks.

_

Read Also:

Top 20 Best Payment Gateway Services in Singapore

_

7. No Fees Attached

One of the best things about PayNow is that it’s free for individuals. There are no hidden charges or transaction fees, making it a cost-effective way to transfer money. Businesses do incur a nominal fee, but it’s generally lower than other payment processing options.

8. Transaction History

PayNow offers a comprehensive transaction history, allowing you to keep track of your spending and payments. This feature is particularly useful for budgeting and financial planning, as you can easily see where your money is going.

9. Linking Multiple Accounts

Did you know that you can link multiple bank accounts to a single PayNow profile? This feature allows for greater flexibility, as you can choose which account to debit for different transactions. It’s a small but impactful feature that enhances user experience.

10. Future Developments

PayNow is not resting on its laurels. Plans are in the pipeline to expand its features, including international transfers and integration with other payment platforms. The aim is to make PayNow a one-stop solution for all your payment needs, further solidifying its role in Singapore’s digital landscape.

Conclusion

PayNow is more than just a convenient way to send money; it’s a cornerstone of Singapore’s push toward becoming a Smart Nation. From its humble beginnings to its current widespread use, PayNow has continually evolved to meet the needs of its diverse user base. Whether you’re a business owner, a busy parent, or a tech-savvy youth, PayNow has something to offer you. So the next time you use PayNow, you’ll do so with a newfound appreciation for this incredible platform.

Frequently Asked Questions (FAQ)

Q1: How does PayNow contribute to financial inclusivity in Singapore?

A1: PayNow promotes financial inclusivity by providing a user-friendly platform, fostering a more connected and accessible financial landscape.

Q2: Can I use PayNow across different banks in Singapore?

A2: Yes, PayNow ensures universal accessibility, allowing seamless transactions between users, regardless of their banking institutions.

Q3: How does PayNow simplify bill payments?

A3: PayNow streamlines bill payments, making the process remarkably easy, and eliminating the hassle associated with traditional payment methods.

Q4: What makes PayNow’s QR code feature special for users in Singapore?

A4: PayNow harnesses QR code technology for quick and effortless transactions, enhancing the convenience of financial interactions for users in Singapore.

Q5: How can I send money using PayNow without account numbers?

A5: Bid farewell to long account numbers; with PayNow, you can send money using just the recipient’s mobile number.

Q6: Does PayNow support instant transfers, and is it available 24/7?

A6: Absolutely, PayNow ensures instant transfers, guaranteeing that your money reaches its destination almost instantly, 24/7.

Have an Article to Suggest?

Tropika Club is always looking for new and exciting content to feature in their magazine and they value the input of our readers. If you have any noteworthy content or articles that you believe would be a great addition to Tropika Club’s magazine, we are open to suggestions and encourage you to reach out to us via email at [email protected]. By doing so, Tropika Club values your expertise and knowledge in the matter and appreciates your willingness to help. We will review your recommendations and update our list accordingly

Meanwhile, Check Out Tropika Club’s Ecosystem of Websites

Tropika Club Magazine – Tropika Club Magazine is a Singapore-based publication that features articles on a wide range of topics with a focus on local businesses and content for the region. The magazine emphasizes supporting local businesses through its #SupportLocal initiative, which includes coverage of everything from neighborhood hawker stalls to aesthetic clinics in town. In addition to highlighting local businesses, Tropika Club Magazine also covers a variety of local content, including beauty, lifestyle, places, eats, and what’s on in Singapore and the Asia Pacific region.