Top 20 Best Payment Gateway Services in Singapore

Let the best Payment Gateway Services in Singapore kick start your business. You might not think much of it, but choosing the right payment gateway could be the key to the success of your business. Bad payment gateway services could give your customers a bad checkout process, leading to lost sales. One thing that could help is to imagine how your business will be growing. For example, if you’re sticking to local markets, a payment gateway that prioritises PayPal might not be the best choice, since more Singaporeans may prefer to use PayNow instead. May you find the right payment gateway services to take your business to the next level.

No Time to Read? Here’s a Snappy Summary of This Article

- Payment Revolution Unleashed: Discover Singapore’s top players like Stripe and DBS PayLah! reshaping the online transaction landscape with finesse.

- Nium’s Global Finesse: Nium conquers global payments, offering a multi-currency wallet and cutting-edge cross-border financial solutions for businesses.

- GrabPay’s Digital Symphony: GrabPay transforms smartphones into digital wallets, orchestrating seamless transactions and alluring rewards for users in Singapore.

- eWAY’s Secure Financial Haven: eWAY makes waves in Singapore, ensuring secure online payments, multiple options, and global transactions with impressive reliability.

- SmoovPay’s Digital Magic: SmoovPay adds a touch of magic to Singapore’s online payments, offering security, customization, and seamless integration for businesses.

- Mobile Wallet Wonder – DBS PayLah!: DBS PayLah! dazzles as a mobile wallet maestro, simplifying transactions and bill-splitting, elevating the payment game in Singapore.

Table of Contents

- No Time to Read? Here’s a Snappy Summary of This Article

- 1. Stripe

- 2. PayPal

- 3. DBS PayLah

- 4. HitPay

- 5. Liquid Gateway

- 6. eNETS

- 7. Adyen

- 8. eWay

- 9. SmoovPay

- 10. Braintree

- 11. WorldPay

- 12. GrabPay

- 13. AsiaPay Singapore

- 14. Hoolah

- 15. PayDollar Singapore

- 16. STICPAY

- 17. Google Pay

- 18. Checkout.com

- 19. Nium

- 20. FOMOPay

- Meanwhile, Check Out Tropika Club’s Ecosystem of Websites

1. Stripe

Introduction:

Stripe Payments is a payment processing platform. It allows you to transfer money from a customer’s bank account into your business’s account by way of a credit or debit card transaction. That’s a pretty simplified explanation, but we’ll get more into the details later. Founded in 2010, Stripe has become a popular choice for e-commerce platforms, subscription-based services, and other online businesses.

They bring together everything that’s required to build websites and apps that accept payments and send payouts globally. Stripe’s products power payments for online and in-person retailers, subscription businesses, software platforms and marketplaces, and everything in between.

They also help companies beat fraud, send invoices, issue virtual and physical cards, reduce friction at checkout, get financing, manage business spend, and much more. Stripe makes moving money as easy and programmable as moving data. Their teams are based in offices around the world and they process hundreds of billions of dollars each year for ambitious businesses of all sizes.

Features:

- Global Payments

- Accept payments online, in-person, or through your platform.

- Revenue and Finance Automation

- Grow your business with automated revenue and finance.

- Banking-as-a-Service

- Embed financial services in your platform or product

Email: [email protected]

Website: https://stripe.com/en-sg

2. PayPal

Introduction:

Millions of businesses choose the PayPal Commerce Platform to power their business at home and abroad. Whether you’re just getting started, or already a thriving enterprise or marketplace, the PayPal Commerce Platform is designed to help serve the needs of your business and your customers around the world.

Leveraging their two-sided network, the PayPal Commerce Platform lets you connect with more than 340+ million PayPal customers in over 200 markets and is available on many of the world’s leading platforms and marketplaces. Access new markets, new channels to sell, and new customers nearly anywhere in the world, while giving your customers the choice to pay in any way they want.

This online payment system makes paying for things online and sending and receiving money safe and secure. When you link your bank account, credit card or debit card to your PayPal account, you can use PayPal to make purchases online with participating stores. PayPal serves as a middleman between your bank and merchants and keeps your payment information secure.

Whether you’re a small business, ecommerce platform, marketplace, enterprise, or developer, the PayPal Commerce Platform offers diverse tools to help run your business and help it grow.

Features:

- Accept payments

With PayPal, your customers can pay in many different ways — whether you sell online, by phone, or through email. Offer credit and debit cards, as well as alternative payment methods only available from PayPal, like PayPal and PayPal Credit.

- Make payments

With the PayPal Commerce Platform, get access to your money quickly and easily, so you can manage your cashflow, pay suppliers, send funds to other PayPal users and make online purchases.

- Manage risk

Security isn’t an add on. It’s been engineered to help protect your transactions, wherever they originate, letting you focus on running your business. You’ll benefit from their global expertise, fraud detection, and tools like Seller Protection – all created to give you greater peace of mind.

- Streamline operations

When your back office runs more smoothly, you can focus on the things you love—the front end of your business. Their account management dashboards help your operations become more organised. They give you reporting and analytics, dispute resolution, Plus, everything is integrated, helping to extend your capabilities while customising your payments.

Website: https://www.paypal.com/sg/business

3. DBS PayLah

Introduction:

DBS PayLah! is a mobile wallet and digital payment service offered by DBS Bank, a prominent bank in Singapore. It allows users to make payments, transfer funds, and perform various financial transactions using their smartphones. With DBS PayLah!, users can link their bank accounts, credit cards, or debit cards to the app, enabling them to make seamless and secure transactions.

Additionally, DBS PayLah! often incorporates features like QR code payments, allowing users to make transactions by scanning QR codes at supported merchants. It is part of the broader trend of digital wallets and mobile payment solutions that aim to provide convenient and efficient ways for individuals to manage their finances in the digital era.

Plus, you can earn and manage your card rewards points seamlessly or collect stamp cards that give you cashback. With over 2 million users and growing, PayLah! lets you live more and enjoy the things you love every day, effortlessly! PayLah! not only makes it easy for you to get your everyday needs, it rewards you for it! From stamp cards that give you cashback for your favourite meals and daily rides, to simple ways to manage and redeem your DBS/POSB Cards rewards points, plus exclusive deals just for you.

As the creators of digibanking, they’re here to make your every interaction with their as seamless and secure as possible. This means checking your balances confidentially on digibank, whilst earning and managing even more rewards on PayLah!. So whether you’re planning your finances securely with digibank or cruising through your everyday transactions effortlessly with PayLah!, you’ll enjoy a turbocharged digibanking experience with DBS.

Features:

- Everyday needs, all on PayLah!: Get rides, book shows, order food, and pay bills, and more!

- Make payments effortlessly: Request payments from your friends, or send money to anyone, including users who are registered on PayNow.

- Auto top-ups: Enable Auto Debit to link your PayLah! wallet via digibank for seamless payments from your account so you never have to top up.

- View eStatements: See all your PayLah! eStatements within the app. Find out more.

- Scan and PayLah!: Go cashless at over 180,000 acceptance points islandwide! Now available overseas.

Website: https://www.dbs.com.sg/personal/deposits/pay-with-ease/dbs-paylah

4. HitPay

Introduction:

HitPay Payment Solutions Pte Ltd is currently carrying on business under an exemption granted by the Monetary Authority of Singapore and is currently exempted from holding a licence to provide payment services under the Payment Services Act (No. 2 of 2019). HitPay Payment Solutions Pte Ltd continues to provide such services pursuant to the Payment Services (Exemption for Specified Period) Regulations 2020.

HitPay helps over 15,000 businesses across Southeast Asia and around the globe process payments efficiently and securely. They unify online, point of sale, and B2B payments into a single, integrated payment processing system. Security is a top priority for them. Their online payment system employs advanced security measures, including encryption and compliance with industry standards like PCI DSS, to ensure the security of your transactions and data.

HitPay likely provides a user-friendly interface, ensuring that both merchants and customers can navigate the platform effortlessly. A well-designed and intuitive interface can enhance the overall payment experience, making transactions smoother and more efficient. HitPay may prioritize fast and secure transactions, employing advanced encryption and security measures to protect sensitive financial information. This ensures that users can trust the platform with their payments and that transactions occur promptly.

Seamless payments are often associated with the ability to integrate with various platforms and systems. HitPay may provide APIs or plugins that allow businesses to integrate the payment solution seamlessly into their websites, apps, or POS systems, streamlining the overall payment process.

Features:

- Online Payments: Increase sales conversions and save costs with a full range of domestic and cross-border payment methods on one single platform.

- In-Person Payments: Accept POS payments with our credit card terminal or directly on your mobile device. Enjoy pay-per transaction pricing, without any rental monthly fees.

- Integrations: Enable payments on your online store with our full range of e-commerce plugins. Set up in minutes, without a line of code.

- No-Code Tools: Create a customisable payment link in a few clicks or send professional invoices over email. We make it easy to get paid — zero coding required.

- APIs: Integrate once to scale across multiple markets and geographies. HitPay offers one-time and recurring online payment processing APIs for website, app, and platform developers.

Email: [email protected]

Website: https://www.hitpayapp.com/

5. Liquid Gateway

Introduction:

Liquid Gateway was strategically built just for you. Whether you’re a business owner, entrepreneur or freelancer, they provide the complete set of powerful payment features for users to experience the ultimate online payment service while removing all confusing technical jargon. Their platform is designed for the highest levels of reliability, speed, security and scalability.

When local businesses grow, their entire community grows. That’s why they’re supporting SMEs by constantly innovating and garnering solutions to help elevate their overall businesses. Over the years they have also conducted multiple business masterclasses to teach rising business owners relevant strategies and growth tips to increase revenue and exposure.

Liquid Gateway provides merchants the full acquiring facilities needed for payment gateways in all industries. Business owners can now avoid separate gateway fees and internet merchant account fees charged from other providers. Stay ahead of your competitors by leveraging on their global network and expertise. They are widely available in European, Africa, Latin America and Asia Pacific. Reduce integration efforts when your business expands internationally.

Liquid Gateway offers the most reasonable prices in the market for a payment gateway that is simple, scalable and reliable. Regardless if you are a startup or a large company – upgrading your business can be as easy as clicking a button and as fast as 3 minutes.

Features:

- E-COMMERCE SOLUTIONS: Expand your business in safe hands and mitigate risks with their security systems, powered to beat fraud and potential attacks.

- TERMINAL SOLUTIONS: Accept payments the way your customers want – secure, fast, reliable. Our all-in-one wireless terminals accept a wide variety of payments quickly, safely and easily.

- DYNAMIC CURRENCY CONVERSION: Integrate a value added service for your international customers and earn additional revenue from foreign currency exchange rates at the same time.

- BATCH PROCESSING: The ultimate online payment solution that allows you to manage, schedule and process large transaction volumes simultaneously by simply uploading a single file.

Email: [email protected]

Website: https://liquidgateway.com/

Read Also:

How to Book and Pay Your Service via NETS QR on Tropika Club

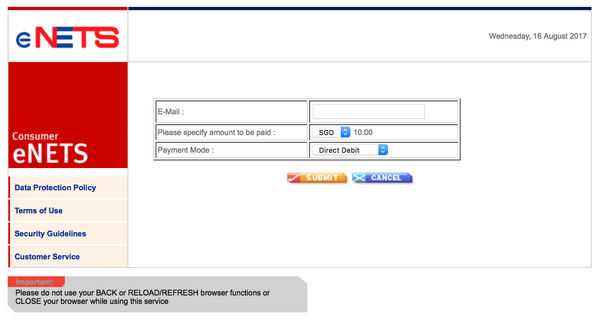

6. eNETS

Introduction:

eNETS Singapore stands as a trailblazer in the realm of electronic payments, offering innovative and secure financial solutions that redefine the landscape of digital transactions. Established with the mission to empower businesses and consumers alike, eNETS has emerged as a leading electronic payment service provider, leveraging cutting-edge technology to facilitate seamless and efficient financial transactions in Singapore and beyond.

At the heart of eNETS’ success lies its commitment to providing a diverse array of payment solutions tailored to meet the evolving needs of the modern economy. Serving as a catalyst for digital transformation, eNETS enables businesses to navigate the intricate landscape of electronic payments with unparalleled ease. The platform caters to a broad spectrum of industries, including e-commerce, retail, travel, and more, fostering a comprehensive ecosystem that adapts to the intricacies of each sector.

One of the hallmark features of eNETS is its unwavering dedication to user-friendly interfaces and customer-centric experiences. Recognizing the significance of a seamless payment process, eNETS has meticulously crafted its services to ensure that both merchants and consumers encounter a frictionless journey from initiation to completion. Whether through online platforms or brick-and-mortar establishments, eNETS seamlessly integrates with various touchpoints, providing a harmonious and efficient payment experience.

Security stands as a paramount concern in the digital age, and eNETS remains at the forefront of addressing this imperative. Employing state-of-the-art encryption technologies and robust security protocols, eNETS safeguards the integrity of financial transactions, instilling confidence among users. This unwavering commitment to security extends to every facet of the platform, creating a fortified environment where users can engage in electronic payments with peace of mind.

Features:

- Direct debit: Accepts direct debit payment from internet banking customers of DBS/POSB, OCBC, Standard Chartered Bank and UOB.

- Easy integration: Integrates easily with bilingual local customer support.

- 3D secure: Verified by Visa, MasterCard SecureCode and American Express Safekey.

- NETS QR Online: Simpler, faster online checkout with QR codes

Contact: +65 6274 1212 (Hotliine)

Website: https://www.nets.com.sg/business/ecommerce-solutions/enets-gateway/

7. Adyen

Introduction:

Adyen Payment Gateway emerges as a dynamic force in the realm of financial technology, reshaping the landscape of electronic payments with its cutting-edge solutions. Renowned for its global presence and unwavering commitment to innovation, Adyen has firmly established itself as a preferred choice for businesses seeking a seamless, efficient, and secure payment processing experience. Within the vibrant economic hub of Singapore, Adyen stands as a pivotal player, catalyzing the digital transformation of commerce and setting new benchmarks in financial technology.

At its core, Adyen is more than just a payment gateway; it is an all-encompassing platform that empowers merchants with a comprehensive suite of services. From facilitating online transactions to enabling point-of-sale payments and catering to mobile commerce, Adyen seamlessly integrates diverse payment methods, providing a unified solution that adapts to the multifaceted demands of the modern marketplace.

Adyen’s ascendancy can be attributed to its relentless pursuit of technological excellence. The platform leverages a sophisticated infrastructure that not only ensures lightning-fast transaction processing but also prioritizes data security with the highest standards of encryption and compliance. This robust combination of speed and security is integral to Adyen’s appeal, fostering an environment where businesses and consumers alike can engage in transactions with confidence.

The user-centric design philosophy of Adyen extends beyond its technical capabilities. The platform is designed to be intuitive, ensuring that merchants can easily navigate its features and functionalities. Moreover, Adyen emphasizes transparency in its fee structures, empowering businesses with clear insights into their financial transactions and enabling them to optimize their payment strategies.

Features:

- Unified Payment Solution: Adyen offers a comprehensive and unified payment solution that covers various payment methods, including credit cards, digital wallets, and alternative payment methods.

- Global Reach and Multi-Currency Support: With a strong emphasis on international transactions, Adyen provides businesses with the ability to accept payments in multiple currencies.

- Advanced Security Measures: Adyen places a high priority on security, implementing advanced encryption and compliance measures to safeguard sensitive payment data.

- Real-Time Analytics and Reporting: Adyen equips businesses with powerful analytics and reporting tools that offer real-time insights into transaction data. Merchants can access comprehensive reports, monitor sales performance, and gain valuable insights into customer behavior.

Contact: https://www.adyen.com/contact

8. eWay

Introduction:

eWAY is a payment gateway service that facilitates online transactions for businesses. It allows merchants to securely accept payments on their websites, enabling customers to make purchases using various payment methods, including credit cards and digital wallets. eWAY serves as an intermediary between the online store and the payment processor, ensuring that transactions are processed securely and efficiently.

They started in 1998 with a vision of making online payments effortless and still that promise rings true today. From humble beginnings working out of the home of their Founder, to now employing more than 310 payments experts, delivering payment solutions for more than 28,000 merchants, across five countries.

In the vibrant business environment of Singapore, eWay serves as a catalyst for progress, providing a robust payment gateway that caters to the diverse needs of businesses, from burgeoning startups to established enterprises. With a primary focus on simplicity and efficiency, eWay ensures that merchants can effortlessly integrate its payment solutions into their existing platforms, be it e-commerce websites, mobile applications, or brick-and-mortar point-of-sale systems.

One of the standout features of eWay is its dedication to offering a variety of payment options. Understanding the importance of catering to a broad customer base, eWay supports a range of payment methods, including credit/debit cards, digital wallets, and other alternative payment solutions. This versatility not only enhances the customer experience but also positions businesses to capture a wider market share by accommodating diverse consumer preferences.

Security is paramount in the realm of electronic payments, and eWay prioritizes this aspect with advanced encryption technologies and stringent security protocols. Merchants leveraging the eWay Payment Gateway can rest assured that sensitive financial information is shielded from potential threats, instilling confidence among both businesses and their customers.

Features:

- Taking Payments: Credit cards, subscriptions, refunds and more

- Multiple Ways To Integrate: Accept payments fast in a way that suits you

- Advanced Cybersecurity: Backed by leading secure payment technology

- Merchant Tools :Insights, reporting and manage transactions

Contact: https://eway.io/sg/contact/

Website: https://eway.io/sg/

9. SmoovPay

Introduction:

SmoovPay Payment Gateway, a beacon of innovation in Singapore’s thriving financial technology sector, stands at the forefront of electronic payment solutions, providing businesses with a state-of-the-art platform to orchestrate seamless and efficient transactions. Positioned as a key player in the dynamic landscape of digital commerce, SmoovPay has earned its reputation by melding cutting-edge technology with an unwavering commitment to user-centric design, reshaping the way businesses engage in online and offline transactions.

In the bustling economic hub of Singapore, SmoovPay has emerged as a trusted ally for enterprises seeking a versatile and secure payment gateway. The platform’s hallmark lies in its adaptability, catering to businesses of all sizes, from startups embarking on their entrepreneurial journey to established corporations navigating the complexities of global commerce. SmoovPay’s versatility is evident in its ability to seamlessly integrate with a myriad of platforms, including e-commerce websites, mobile applications, and traditional point-of-sale systems, ensuring that businesses can harness its capabilities across diverse touchpoints.

A defining feature of SmoovPay is its commitment to simplicity without compromising sophistication. The platform offers an intuitive interface that streamlines the payment process, facilitating a user-friendly experience for both merchants and customers. Recognizing the importance of variety in the modern marketplace, SmoovPay supports a wide array of payment methods, including credit and debit cards, digital wallets, and other alternative payment solutions. This diversity not only enhances customer satisfaction but also positions businesses to cater to a broad spectrum of consumer preferences.

SmoovPay is steadfast in its commitment to providing a secure environment. Employing cutting-edge encryption technologies and robust security protocols, the platform ensures that sensitive financial data remains safeguarded, instilling confidence among businesses and consumers alike.

In essence, SmoovPay Payment Gateway epitomizes the evolution of electronic payments in Singapore, offering a harmonious blend of technological prowess, adaptability, and security. As the financial technology landscape continues to evolve, SmoovPay stands poised to lead the charge, driving innovation and redefining the standards for a seamless and secure payment experience in the digital age.

Features:

- Zero Setup Fee: The first step is always the hardest step to take, so they would like to make it really easy for you, Sign up with them for FREE! There are absolutely no maintenance fee.

- Pay only when you sell: It doesn’t make sense to pay if you are not using their services. Hence they charge a small fee for every transaction with rate starting from 2.9% on the total sale amount plus a fixed fee of $0.25 per transaction.

- Free monthly withdrawal: As your business blossom and money starts coming in, they securely transfer your earnings to you on every first friday of the month. The best thing is, it’s FREE!

Contact: https://merchant.smoovpay.com/contact

Website: https://merchant.smoovpay.com/

10. Braintree

Introduction:

Braintree Payment Gateway, a trailblazer in the realm of electronic payments, has etched its mark on the vibrant landscape of Singapore’s financial technology sector. Renowned for its innovative approach and commitment to providing businesses with a robust and adaptable payment solution, Braintree stands as a key player reshaping the dynamics of digital transactions in the modern economy.

Nestled in the heart of Singapore’s bustling business environment, Braintree has emerged as a go-to platform for enterprises seeking a comprehensive and seamless payment processing experience. The platform’s versatility is a cornerstone of its appeal, catering to businesses of all sizes and industries, from startups navigating their initial foray into e-commerce to established corporations managing complex global transactions. Braintree seamlessly integrates with various platforms, including websites, mobile applications, and point-of-sale systems, offering businesses the flexibility to leverage its capabilities across diverse channels.

At the core of Braintree’s success lies its commitment to simplicity and sophistication. The platform provides an intuitive and user-friendly interface that streamlines the payment process, fostering a positive experience for both merchants and customers. This emphasis on a seamless user journey extends to Braintree’s support for a wide array of payment methods, ranging from major credit and debit cards to digital wallets and alternative payment solutions, ensuring that businesses can accommodate the diverse preferences of their customer base.

Braintree stands as a fortress against potential threats. Employing cutting-edge encryption technologies and stringent security measures, Braintree ensures the confidentiality and integrity of sensitive financial data, instilling trust among businesses and consumers engaging in electronic transactions.

Braintree Payment Gateway represents a paradigm shift in Singapore’s electronic payments landscape, embodying the fusion of technological innovation, adaptability, and security. As the financial technology sector continues to evolve, Braintree remains at the forefront, driving the evolution of seamless and secure digital transactions and setting new standards for businesses navigating the complexities of the modern marketplace.

Features:

- Fraud Tools: Help detect and prevent fraudulent transactions.

- Data Security: Safeguard your customer’s information.

- Payment Methods: Accept cards, PayPal, Venmo (in the US), and more.

- Reporting: Get key transaction insights.

- Global Scale: Reach customers all over the world.

- Payouts: Pay your sellers and freelancers globally.

- In-store Payments: Go from e-tail to retail with POS tools.

Contact: https://www.braintreepayments.com/sg/contact

Website: https://www.braintreepayments.com/au

11. WorldPay

Introduction:

WorldPay Payment Gateway, a luminary in the constellation of Singapore’s fintech landscape, stands as a beacon of innovation, seamlessly connecting businesses to the global stage of electronic transactions. Nestled within the city-state’s vibrant financial ecosystem, WorldPay has emerged as a transformative force, reshaping the contours of digital payments and spearheading a new era of financial fluidity.

In the heart of Singapore’s bustling business district, WorldPay orchestrates a symphony of electronic transactions, where every note resonates with technological prowess and financial finesse. The platform transcends conventional notions of a payment gateway, positioning itself as an architect of seamless commerce experiences for businesses of all scales. From the burgeoning startup venturing into the digital realm to the established enterprise navigating the complexities of international trade, WorldPay is the catalyst that propels transactions into a realm of efficiency and sophistication.

At the core of WorldPay’s allure is its adaptability, akin to a versatile virtuoso attuned to the diverse needs of its audience. The platform seamlessly integrates into a myriad of business models, from the intricate dance of e-commerce platforms to the rhythmic cadence of brick-and-mortar establishments. WorldPay’s universal compatibility ensures that regardless of the stage, businesses can leverage its capabilities to create a symphony of payments that resonates with the global market.

Features:

- A faster way: They make online payments quick & easy

- Safe and secure: World-class fraud prevention

- The UK’s #1 payments provider: They process 26 million transactions per day

Email: [email protected]

Website: https://online.worldpay.com/

12. GrabPay

Introduction:

GrabPay is a mobile wallet and digital payment service offered by Grab, a Southeast Asian technology company that provides various services, including ride-hailing, food delivery, and financial services. GrabPay allows users to make cashless transactions, both online and offline, using their smartphones. The service was initially introduced as a way to facilitate payments for Grab’s ride-hailing and food-delivery services but has since expanded to support a broader range of transactions.

In the dynamic landscape of Singapore’s financial technology arena, GrabPay Payment Gateway emerges as a transformative force, seamlessly intertwining the realms of finance and technology to redefine the very fabric of digital transactions. Nestled within the heartbeat of Southeast Asia’s bustling city-state, GrabPay stands not just as a payment gateway but as a symbol of innovation, connectivity, and the evolving nature of modern commerce.

As an integral part of the Grab ecosystem, GrabPay Payment Gateway extends the ubiquitous Grab super app’s reach into the realm of electronic payments, offering a holistic solution that caters to the diverse needs of businesses and consumers alike. What sets GrabPay apart is its symbiotic relationship with the broader Grab ecosystem, providing users with a seamless experience that integrates ride-hailing, food delivery, and a myriad of other services into the fabric of daily life.

In the vibrant streets of Singapore, GrabPay weaves itself into the tapestry of urban living. From hailing a ride to enjoying a delicious meal, GrabPay is omnipresent, offering users the convenience of a cashless, integrated lifestyle. This unique synergy with everyday activities positions GrabPay as not just a payment gateway but as an enabler of a more connected and frictionless existence.

A defining feature of GrabPay is its commitment to financial inclusion. The platform empowers users with diverse payment methods, from traditional credit and debit cards to e-wallet functionalities, providing a gateway to a cashless future. Merchants, in turn, benefit from the platform’s widespread user base, tapping into a vast network of Grab users who seamlessly transition between services within the app.

Features:

- Food delivery service.

- Online Grocery delivery.

- Transport Delivery.

- Online Package Delivery.

- Online Movie ticket booking.

- Online Hotel Booking.

Website: https://www.grab.com/sg/pay/

13. AsiaPay Singapore

Introduction:

AsiaPay Payment Technology Pte. Ltd., or more publicly known as AsiaPay Singapore, is a wholly owned subsidiary of AsiaPay Limited which is one of the leading payment service providers in the Asia Pacific region.

AsiaPay Singapore Payment Gateway, a stalwart in the realm of electronic payments, stands as a pillar of financial innovation within the dynamic landscape of Singapore’s flourishing fintech sector. With a legacy deeply rooted in pioneering cutting-edge payment solutions, AsiaPay has established itself as a key player, crafting a narrative of seamless transactions, technological prowess, and unwavering commitment to customer-centric financial experiences.

Nestled within the beating heart of Singapore’s financial district, AsiaPay is emblematic of the city-state’s commitment to driving the future of digital commerce. As a trusted partner for businesses seeking to navigate the intricacies of online transactions, AsiaPay offers a comprehensive suite of services, ranging from secure payment gateways to advanced fraud prevention mechanisms.

At the core of AsiaPay’s value proposition lies its dedication to providing businesses with a flexible and adaptive payment infrastructure. The platform seamlessly integrates with various business models, accommodating the needs of diverse industries, from e-commerce enterprises to traditional retail establishments. This versatility positions AsiaPay as a strategic ally for businesses of all sizes, fostering an environment where transactions are not just conducted but orchestrated with precision.

AsiaPay’s user-centric design philosophy is evident in the platform’s intuitive interfaces, ensuring a seamless experience for both merchants and consumers. The emphasis on simplicity extends to its support for a wide array of payment methods, including credit and debit cards, digital wallets, and alternative payment solutions, catering to the preferences of a diverse and evolving customer base.

AsiaPay addresses security concerns with an unwavering commitment to robust security protocols. Utilizing advanced encryption technologies, the platform safeguards sensitive financial data, instilling trust and confidence in both businesses and consumers engaging in electronic transactions.

Features:

- Comprehensive Payment Methods:: AsiaPay is likely to support a diverse range of payment methods, including major credit and debit cards, popular digital wallets, and other alternative payment options.

- Global Currency Support: To facilitate international transactions, AsiaPay provides support for multiple currencies.

- Buy Now Pay Later: Provide consumers with greater payment flexibility and convenience, help them to buy and spend more in a tight budget.

Email: [email protected]

Website: https://www.asiapay.com.sg/

14. Hoolah

Introduction:

Hoolah is Asia’s leading omni-channel buy now pay later platform. Headquartered in Singapore they are live in Singapore, Malaysia and Hong Kong and expanding rapidly. They help merchants in Asia to solve the critical challenges of generating new customers, getting them to return, conversion and basket size by driving consumer affordability – responsibly.

In the dynamic landscape of Singapore’s financial technology sector, Hoolah emerges as a trailblazer, offering a revolutionary approach to electronic payments that resonates with the evolving preferences of modern consumers. As a prominent player in the city-state’s fintech ecosystem, Hoolah’s presence reverberates beyond conventional payment gateways, embodying a paradigm shift in the way individuals and businesses engage in transactions.

Hoolah introduces a refreshing perspective to the world of payment solutions. Unlike traditional methods, Hoolah champions the concept of “Buy Now, Pay Later” (BNPL), providing consumers with the flexibility to spread the cost of their purchases over multiple installments without incurring interest or hidden fees. This innovative approach caters to the changing dynamics of consumer behavior, empowering individuals to make purchases without immediate financial strain.

Hoolah’s allure extends beyond its commitment to financial flexibility. The platform seamlessly integrates into the fabric of various businesses, offering a frictionless and user-friendly experience. Whether online or in-store, Hoolah’s Buy Now, Pay Later solution harmonizes with diverse business models, creating a symbiotic relationship between merchants and consumers.

At the core of Hoolah’s philosophy is the democratization of affordability, making quality products and services accessible to a broader audience. This strategic approach not only enhances the purchasing power of consumers but also fuels business growth by expanding the customer base.

Features:

- New customers: Tap into hoolah’s network of millions of premium shoppers

- Amplify sales: Drive conversions, basket size and repeat purchases to grow your business

- Minimise risk: We pay you up-front, and you take on no risk – from chargebacks to fraud

- Easy setup: Setup in just a few days, whether for your website or your retail stores

Email: [email protected]

Website: https://www.hoolah.co/sg-en/

15. PayDollar Singapore

Introduction:

In the heart of Singapore’s financial hub, PayDollar emerges as a stalwart in the realm of electronic payments, crafting a narrative of innovation, reliability, and seamless financial transactions. As a leading payment gateway provider, PayDollar stands at the nexus of the city-state’s bustling financial technology ecosystem, providing businesses with a sophisticated platform to navigate the intricate landscape of digital commerce.

Founded on the principles of efficiency and adaptability, PayDollar offers a comprehensive suite of payment solutions that caters to the diverse needs of businesses across various industries. Whether it’s an e-commerce venture seeking to enhance its online payment capabilities or a brick-and-mortar establishment venturing into the digital realm, PayDollar’s versatile features seamlessly integrate into different business models, fostering a unified and frictionless payment experience.

At the forefront of PayDollar’s appeal is its commitment to user-friendly interfaces and seamless integration options. The platform provides businesses with intuitive tools to manage transactions effortlessly, while its adaptable integration capabilities, including APIs and plugins, ensure a smooth and efficient incorporation of PayDollar’s services into existing infrastructures.

In the ever-evolving landscape of digital payments, PayDollar’s support for an array of payment methods stands as a testament to its dedication to customer-centricity. The platform facilitates transactions through major credit and debit cards, popular digital wallets, and other alternative payment options, ensuring that businesses can cater to a broad spectrum of customer preferences.

In the rich tapestry of Singapore’s financial technology narrative, PayDollar emerges not merely as a payment gateway but as a guardian of seamless transactions, a catalyst for business growth, and a custodian of trust in the digital realm. As Singapore continues to be a focal point for fintech innovation, PayDollar remains steadfast, shaping the trajectory of electronic payments and embodying the essence of a reliable financial companion in the digital age.

Features:

- Multiple Payment Options: Accept payments online via credit cards, internet banking, and cross-border options like WeChat Pay and Alipay in one platform

- Multi-Channel Processing: Take online payments seamlessly across channels – online, in-store, on-the-go, or even through a call center

- Multi-Language Option: Allow shoppers to easily complete transactions using the language they know best – English, Malay, Mandarin, and more

- Multi-Currency & Settlement: Make it easy for online customers across the world to pay for products and services using their preferred currency

- Fraud Management Tool: Decrease chargebacks easily with our fraud tool that sends you notifications whenever a suspicious transaction is detected

- Responsive Mobile Interface: Provide customers with a consistent checkout experience across any device with our mobile-optimized payment pages

Email: [email protected]

Website: https://www.paydollar.com.sg/

16. STICPAY

Introduction:

Sticpay is a global E-wallet service without the boundaries of locations. You can send/receive money via Sticpay account within one minute regardless of where the sender/receiver is.

Amidst the dynamic landscape of Singapore’s financial technology sector, STICPAY emerges as a distinctive player, ushering in a new era of electronic payments with its innovative and secure platform. As a leading payment gateway provider, STICPAY stands as a beacon of financial empowerment, offering businesses and individuals a seamless conduit to navigate the complexities of digital commerce.

Nestled within the bustling heart of Singapore’s financial district, STICPAY embodies a commitment to technological excellence and user-centric design. The platform transcends conventional payment gateways, positioning itself as a comprehensive financial solution that caters to the diverse needs of businesses, from burgeoning startups to established enterprises.

At the core of STICPAY’s appeal is its adaptability to the modern financial landscape. The platform seamlessly integrates into various business models, providing a robust and versatile payment infrastructure. Whether facilitating transactions on e-commerce platforms, mobile applications, or traditional point-of-sale systems, STICPAY ensures that businesses can harness its capabilities across different touchpoints, creating a unified and efficient payment experience.

STICPAY’s user interface reflects its commitment to simplicity and efficiency. Businesses utilizing the platform benefit from an intuitive dashboard that facilitates easy management of transactions, while customers experience a seamless and frictionless payment process. This emphasis on user-friendly design contributes to the overall positive experience associated with STICPAY.

Features:

- Secure: Merchants and customers are monitored with strict KYC (Know Your Customer) and AML (Anti Money Laundering) checks. As all transfers are secure and indemnified, chargeback risks are limited on the platform.

- Cost-effective: STICPAY charges merchants a competitive 2.5% + $0.3 fee for processing fiat and 1.8% for accepting cryptocurrency transactions – and customers themselves have zero fees when paying the merchant.

- Local: Singapore customers can use the local bank wire option to withdraw money from their STICPAY accounts rapidly and cost-efficiently. The local bank wire option allows you to receive and withdraw funds in your own currency.

- Global: STICPAY is available in over 190 countries, with 29 fiat currencies and three cryptocurrencies supported and 19 languages.

Email: [email protected]

Website: https://www.sticpay.com/news/news_detail/payment-gateway-singapore?locale=en_US

17. Google Pay

Introduction:

Google Pay (stylized as G Pay; formerly Android Pay) is a digital wallet platform and online payment system developed by Google to power in-app, online, and in-person contactless purchases on mobile devices, enabling users to make payments with Android phones, tablets, or watches.

Google Pay emerges as a transformative force, offering a dynamic and streamlined approach to electronic payments. As an integral component of the tech giant’s ecosystem, Google Pay seamlessly integrates cutting-edge technology with unparalleled convenience, providing businesses and consumers in the city-state with a sophisticated and intuitive platform for digital transactions.

In the vibrant mosaic of Singapore’s digital economy, Google Pay stands out as a beacon of simplicity and efficiency. Facilitating seamless transactions both online and offline, Google Pay redefines the traditional boundaries of payment gateways by delivering a unified experience across various touchpoints. Whether it’s making purchases on e-commerce platforms, paying for services through mobile apps, or completing transactions at brick-and-mortar stores, Google Pay harmonizes the diverse facets of digital payments.

One of the distinguishing features of Google Pay is its commitment to user-friendly interfaces. The platform’s intuitive design not only simplifies the payment process but also extends to the effortless management of transactions for both merchants and consumers. This emphasis on ease-of-use positions Google Pay as a preferred choice for those seeking a frictionless and accessible digital payment solution.

Security lies at the core of Google Pay’s offerings, reinforcing trust in an era of digital transactions. Utilizing cutting-edge encryption technologies and robust security protocols, Google Pay ensures that sensitive financial information remains protected, providing users with the peace of mind to engage in electronic payments securely.

Features:

- Send & receive money: Transfer money easily to friends & family safely

- Your shared payments stay with the group: When you send a payment with Google Pay, it’ll stay between you and your friends.

- Pay contactless: Pay with your phone anywhere contactless payments are accepted.

- Fuel your next adventure: Find nearby gas stations, see prices, and pay for fuel right from the app.

- Take your phone for a ride: Pay contactless for transit rides where available. Just add a pass or set up a card, then use your phone to ride.

- Shop online: Use Google Pay to checkout quickly and securely when you shop on websites and apps.

Website: https://pay.google.com

18. Checkout.com

Introduction:

Checkout.com empowers businesses to adapt and innovate. The company’s technology makes payments seamless. Flexible solutions, granular data, and instant insights help global enterprises launch new products in new markets and create outstanding customer experiences. Checkout.com provides the fastest, most reliable payments in more than 150 currencies, with in-country acquiring, world-class fraud filters and reporting through one API. Checkout.com can accept all major international credit and debit cards, as well as popular alternative and local payment methods.

Within the dynamic fintech ecosystem of Singapore, Checkout.com stands as a formidable catalyst, redefining the landscape of digital payments with its innovative and robust payment gateway solutions. As a global leader in online payment processing, Checkout.com has seamlessly woven itself into the fabric of Singapore’s thriving digital economy, offering businesses and merchants an advanced platform that transcends traditional boundaries.

Checkout.com’s presence reflects a commitment to technological excellence and a relentless pursuit of providing frictionless payment experiences. The platform goes beyond conventional payment gateways, serving as a comprehensive solution that addresses the diverse needs of businesses across various industries.

At the core of Checkout.com’s appeal is its versatility. The platform effortlessly integrates into diverse business models, from e-commerce giants to small and medium enterprises, providing a unified infrastructure that simplifies the complexities of online transactions. This adaptability positions Checkout.com as a strategic ally for businesses of all sizes, seeking to navigate the nuances of digital commerce in Singapore’s competitive marketplace.

In the unfolding narrative of Singapore’s fintech evolution, Checkout.com stands at the forefront, embodying the convergence of innovation, adaptability, and security in the realm of digital payments.

Features:

- One powerful platform: Streamline your payments through one unified API that evolves with you and responds to change as it happens.

- Global payments coverage: Grow anywhere with local acquiring in major markets, 150+ currencies and most popular payment methods.

- Unrivaled data and insight: Get a radically transparent view of your payments data and instant insights you can change your world with.

Website: https://www.checkout.com/

19. Nium

Introduction:

Nium is a fintech company that specializes in cross-border payments and financial services. Formerly known as InstaReM, Nium rebranded to reflect its broader range of financial solutions beyond remittances. The company provides a platform that allows businesses, financial institutions, and individuals to send and receive money globally.

In the pulsating heart of Singapore’s financial technology sector, Nium takes center stage as a trailblazer in the realm of digital payments, offering a comprehensive and sophisticated payment gateway solution that resonates with the city-state’s dynamic business landscape. As a global fintech powerhouse, Nium has firmly established itself as a transformative force, empowering businesses and individuals alike to navigate the intricacies of the digital economy with unparalleled efficiency and innovation.

Situated amidst the bustling metropolis of Singapore, Nium’s prominence is characterized by its commitment to redefining the payment landscape. The platform, renowned for its agility and versatility, seamlessly integrates into the fabric of diverse business models, from e-commerce ventures to financial institutions, providing a unified and adaptable solution for a wide array of payment needs.

Nium’s appeal extends beyond its adaptability to its commitment to user-centric design. The platform is designed with a focus on simplicity, offering merchants and users alike an intuitive interface for streamlined transaction management. This emphasis on user experience not only enhances the efficiency of payment processes but also contributes to the overall satisfaction of businesses and consumers engaging with Nium.

At the forefront of Nium’s mission is its global perspective. Serving as a conduit for international transactions, Nium supports businesses with multi-currency capabilities, reflecting the platform’s commitment to facilitating seamless cross-border payments. This feature positions Nium as a strategic partner for businesses with a global footprint, allowing them to transact in multiple currencies and expand their reach effortlessly.

Features:

- Global Payouts: Real-time payments infrastructure for on-demand business. Pay to 190+ countries.

- Global Accounts: Simplify funding, collection, conversion, and disbursements to drive borderless growth

- Global Card Issuance: Launch physical and virtual card strategies quickly and easily with authorization models that work for you

- Global FX: Avoid the high-cost intermediaries and get transparency and control to move money anywhere in real time.

Website: https://www.nium.com/

20. FOMOPay

Introduction:

FOMO is a Singapore FinTech company licensed by the Monetary Authority of Singapore (MAS) as a Major Payment Institution, a digital payment & remittance processing platform, with a footprint across Southeast Asia, the Middle East, and Africa. FOMO Pay’s partners include mVISA, WeChat, Grab, NETS, ICBC, OCBC, Citibank, SingTel, etc. Some accolades of FOMO Pay include the winner of the MAS FinTech Award, OCBC Emerging Enterprise Award and CITIBank the most Scalable Solution Award.

In the ever-evolving landscape of Singapore’s digital economy, FOMO Pay emerges as a dynamic and innovative player, contributing to the transformation of payment experiences with its cutting-edge payment gateway solutions. Positioned at the forefront of the city-state’s bustling fintech ecosystem, FOMO Pay stands as a beacon of convenience and technological prowess, offering businesses and consumers a gateway to seamless and efficient digital transactions.

Nestled within the thriving metropolis of Singapore, FOMO Pay is distinguished by its commitment to addressing the evolving needs of businesses in the digital age. The platform seamlessly integrates into diverse business models, from traditional brick-and-mortar establishments to modern e-commerce ventures, providing a comprehensive solution that facilitates a unified and streamlined payment experience.

FOMO Pay’s appeal lies not only in its adaptability but also in its user-friendly design. Merchants leveraging the platform benefit from an intuitive interface, simplifying the management of transactions and enhancing overall operational efficiency. This emphasis on user experience extends to consumers, ensuring a seamless and frictionless payment process that aligns with the expectations of the modern digital consumer.

As a testament to its forward-thinking approach, FOMO Pay acknowledges the importance of staying at the forefront of emerging trends in the fintech space. The platform is designed to accommodate a variety of payment methods, including digital wallets, credit and debit cards, and other alternative payment solutions, ensuring businesses can cater to the diverse preferences of their customer base.

Features:

- FOMO Pay: FOMO Pay is the first of its kind, prioritising the customer’s experience first with a comprehensive suite of digital financial solutions.

- FOMO iBank: Enables your business to make real-time domestic & cross-border payments and money transfer in our network of more than 100 countries.

- FOMO Crypto: ASIA’S 1st LICENSED SOLUTION. Support competitive rates between crypto to fiat conversion.

Website: https://www.fomopay.com/

Conclusion

So, there you have it – the lowdown on the top 20 best payment gateway services in Singapore for 2021. Navigating the world of online transactions can be a bit overwhelming, but with the right payment gateway by your side, it’s smooth sailing. Whether you’re a business looking to provide a seamless checkout experience or a savvy shopper wanting a secure way to pay, these gateways have got you covered.

At Tropika Club Magazine, we believe that staying informed is the key to making smart choices. In the fast-paced world of e-commerce, having a reliable payment gateway is not just a convenience; it’s a necessity. Our top picks have been carefully curated to cater to the diverse needs of the Singaporean market, ensuring that you can trust your transactions to be secure, efficient, and hassle-free.

Frequently Asked Questions (FAQ)

Q: How does Stripe simplify online transactions for businesses in Singapore?

A: Stripe streamlines online transactions by providing a developer-friendly platform, customizable checkouts, and robust analytics, making it a preferred choice.

Q: What makes DBS PayLah! stand out among payment gateways in Singapore?

A: DBS PayLah! shines with its mobile wallet prowess, transforming smartphones into digital wallets for seamless transactions and bill-splitting convenience.

Q: Can businesses in Singapore benefit from eWAY’s payment gateway features?

A: Absolutely, eWAY offers businesses in Singapore secure online payment processing, multiple payment options, and international transaction support for global expansion.

Q: How does GrabPay enhance the payment experience for users in Singapore?

A: GrabPay elevates the payment experience by offering mobile payments for Grab services, digital wallets, and enticing rewards for users in Singapore.

Q: What are the key features of Nium’s cross-border payment solutions?

A: Nium excels in cross-border payments, providing a multi-currency wallet, global network access, and API integration for businesses in Singapore seeking international financial solutions.

Q: How does SmoovPay contribute to the online payment landscape in Singapore?

A: SmoovPay is a player in Singapore’s online payment scene, offering secure online payment processing, customization options, and easy integration for businesses.

Have an Article to Suggest?

Tropika Club is always looking for new and exciting content to feature in their magazine and they value the input of our readers. If you have any noteworthy content or articles that you believe would be a great addition to Tropika Club’s magazine, we are open to suggestions and encourage you to reach out to us via email at [email protected]. By doing so, Tropika Club values your expertise and knowledge in the matter and appreciates your willingness to help. We will review your recommendations and update our list accordingly

Meanwhile, Check Out Tropika Club’s Ecosystem of Websites

Tropika Club Magazine – Tropika Club Magazine is a Singapore-based publication that features articles on a wide range of topics with a focus on local businesses and content for the region. The magazine emphasizes supporting local businesses through its #SupportLocal initiative, which includes coverage of everything from neighborhood hawker stalls to aesthetic clinics in town. In addition to highlighting local businesses, Tropika Club Magazine also covers a variety of local content, including beauty, lifestyle, places, eats, and what’s on in Singapore and the Asia Pacific region.

![Top 20 Best Payment Gateway Services in Singapore [2021 Edition]](https://ejqczs4xhji.exactdn.com/wp-content/uploads/2023/11/Tropka-Club-Magazine-1024-x-768-Top-20-Best-Payment-Gateway-Services-in-Singapore-2021-Edition-.jpg?strip=all&lossy=1&ssl=1)