10 CPF Benefits You Might Not Know About

No Time to Read? Here’s a Snappy Summary of This Article

- CPF LIFE: A lifelong monthly payout scheme that ensures you have a steady income after retirement.

- CPF Investment Scheme: A way to grow your CPF savings by investing in various products such as stocks, bonds, unit trusts, etc.

- CPF Education Scheme: A loan scheme that allows you to use your CPF savings to pay for your own or your children’s tertiary education.

- CPF Housing Scheme: A scheme that helps you buy a home with your CPF savings, either by using them for the downpayment or to service the monthly mortgage.

- CPF Home Protection Scheme: A mortgage-reducing insurance that covers your outstanding home loan in the event of death or permanent disability.

- CPF Medisave: A savings account that helps you pay for your own or your dependents’ medical expenses, such as hospitalization, surgery, outpatient treatment, etc.

Table of Contents

- No Time to Read? Here’s a Snappy Summary of This Article

- 1. CPF LIFE

- 2. Home Protection Scheme (HPS)

- 3. Medisave Maternity Package

- 4. Investment Schemes

- 5. Education Scheme

- 6. CPF Nomination

- 7. ElderShield and CareShield Life

- 8. Top-Up Schemes

- 9. CPF Withdrawal for Renovation

- 10. Tax Relief Benefits

- Meanwhile, Check Out Tropika Club’s Ecosystem of Websites

Introduction

You’ve heard it before—CPF is your best friend for life. But how well do you really know this lifelong companion? We’re not just talking about the basics; we’re diving deep into the lesser-known benefits that could make a world of difference in your life. So, sit back, grab a kopi, and let’s unravel the mysteries of CPF together.

1. CPF LIFE

CPF LIFE is not just another acronym to gloss over. It’s a life annuity scheme that provides you with a monthly payout for as long as you live, starting from the age of 65. While you might be familiar with the standard plans, did you know there are options to defer your payouts to a later age for a higher monthly sum? It’s like having a financial safety net that adjusts to your lifestyle needs.

2. Home Protection Scheme (HPS)

Most Singaporeans use their CPF savings to pay for their HDB flats. But what happens if you’re unable to continue the payments due to unforeseen circumstances? Enter the Home Protection Scheme. This is a mortgage-reducing insurance that covers your outstanding housing loans, ensuring that your family won’t lose their home. It’s a safeguard you might not have known you needed.

3. Medisave Maternity Package

Starting a family in Singapore can be costly, but CPF has got your back. The Medisave Maternity Package allows you to use your Medisave to cover pre-delivery medical expenses. This includes consultations, ultrasounds, and even certain tests. It’s a financial cushion that eases the journey into parenthood.

4. Investment Schemes

If you’re the type who likes to take the bull by the horns, CPF’s various investment schemes are your playground. You can invest your Ordinary Account (OA) and Special Account (SA) savings in a range of financial products, from stocks to gold. It’s a way to grow your nest egg beyond the usual interest rates.

5. Education Scheme

Education is a big deal in Singapore, and CPF wants to help you succeed. You can use your OA savings to pay for your own or your children’s tertiary education. This includes universities, polytechnics, and even certain private institutions. It’s an investment in the future that pays off in spades.

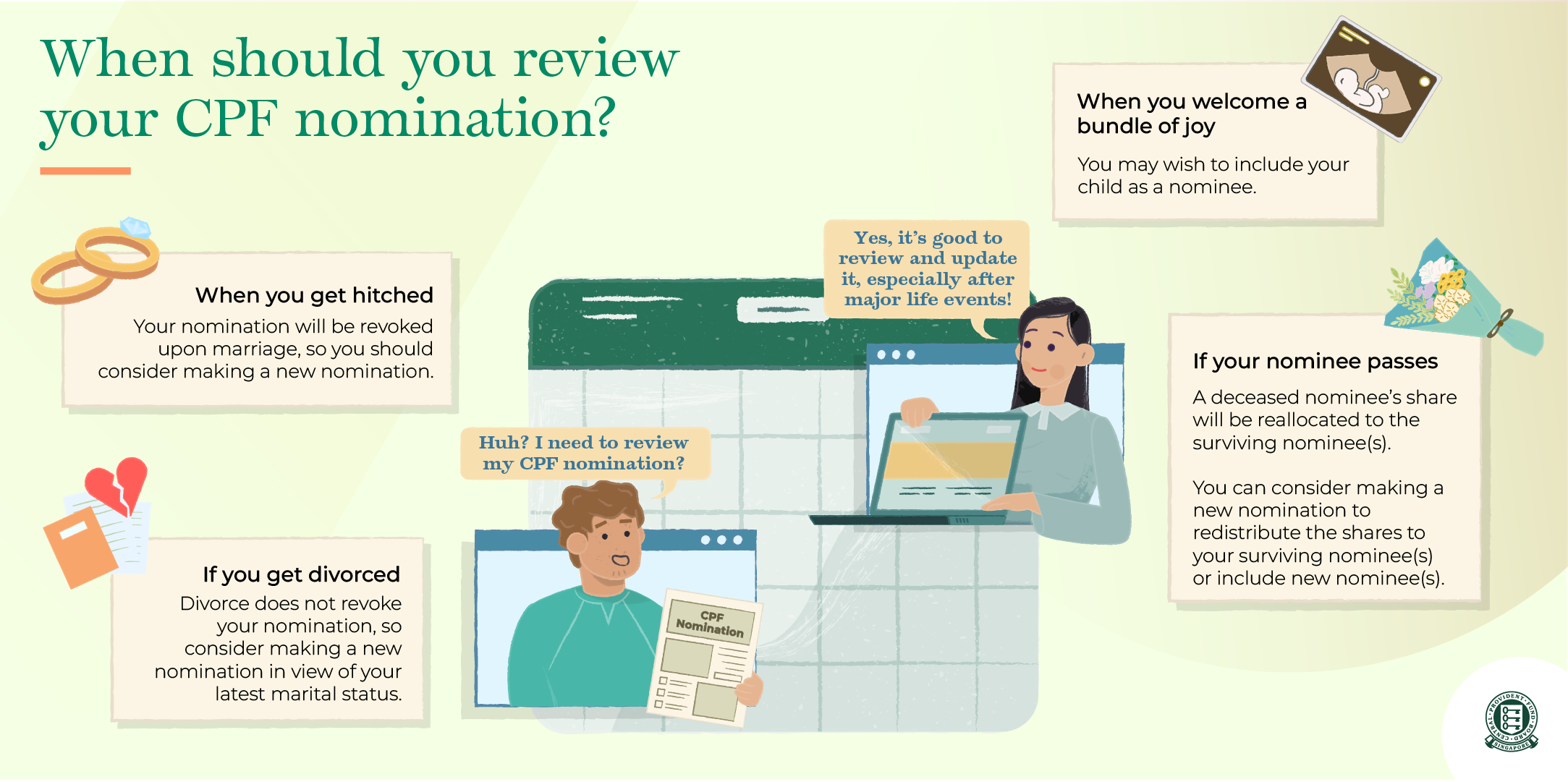

6. CPF Nomination

While it’s a topic many avoid, planning for the inevitable is crucial. CPF Nomination allows you to specify who will receive your CPF savings upon your demise. This ensures that your hard-earned money goes to the people you care about most, without any legal complications.

_

Read Also:

Your Comprehensive Guide to CPF Contributions in Singapore: 10 Essential Facts

_

7. ElderShield and CareShield Life

As you age, healthcare becomes increasingly important. ElderShield and its successor, CareShield Life, are schemes that offer basic financial protection against severe disability. These payouts can be used for various long-term care services, giving you peace of mind in your golden years.

8. Top-Up Schemes

Think your CPF savings aren’t growing fast enough? You can top up your own or your loved ones’ Special Account or Retirement Account through various top-up schemes. These contributions are also tax-deductible, making it a win-win situation for everyone involved.

9. CPF Withdrawal for Renovation

Sprucing up your home is more accessible than you think. You can use your CPF savings to finance renovations, making it easier to turn your house into a dream home. It’s a benefit that adds both comfort and value to your life.

10. Tax Relief Benefits

Last but not least, let’s talk about tax relief. Contributions to your CPF accounts, whether mandatory or voluntary, can earn you tax reliefs. This means you can potentially lower your taxable income, giving you more room to breathe financially.

Conclusion

CPF is more than just a mandatory savings plan; it’s a multifaceted tool designed to enhance various aspects of your life. From housing and healthcare to education and investments, the benefits are numerous and often overlooked. So the next time you grumble about your CPF contributions, remember that it’s not just a fund—it’s a fund full of possibilities.

Frequently Asked Questions (FAQ)

Q: What is the difference between CPF LIFE and Retirement Sum Scheme?

A: CPF LIFE is a lifelong monthly payout scheme that provides you with a steady income for as long as you live. Retirement Sum Scheme is a monthly payout scheme that lasts until your Retirement Account balance is depleted. You can choose to join CPF LIFE anytime from age 65 onwards or remain on the Retirement Sum Scheme if you prefer.

Q: How can I use my CPF savings to pay for my children’s education?

A: You can use your CPF savings to pay for your children’s tuition fees at approved local educational institutions under the CPF Education Scheme. You can apply for the scheme online through the CPF website. The maximum amount you can use is 40% of the lower of the OA balance or the OA withdrawal limit at the time of application.

Q: What are the benefits of topping up my CPF accounts?

A: Topping up your CPF accounts can help you grow your retirement savings, enjoy tax relief, and receive higher interest rates. You can top up your own or your loved ones’ CPF accounts using cash or CPF savings under the Retirement Sum Topping-Up Scheme. You can also top up your Special Account or Retirement Account using cash under the CPF Minimum Sum Topping-Up Scheme.

Q: How can I use my CPF savings to buy a home?

A: You can use your CPF savings to buy a home under the CPF Housing Scheme. You can use your Ordinary Account savings to pay for the downpayment, monthly mortgage installments, and other related costs. You can also use your CPF savings to buy a resale HDB flat, a private property, or an executive condominium.

Q: What is the Home Protection Scheme and how does it work?

A: The Home Protection Scheme is a mortgage-reducing insurance that covers your outstanding home loan in the event of death or permanent disability. It is compulsory for HDB flat owners who use their CPF savings to pay for their monthly housing loan installments. You can apply for the scheme online through the CPF website or through your HDB branch.

Q: How can I use my CPF savings for healthcare expenses?

A: You can use your CPF savings for healthcare expenses under the CPF Medisave Scheme. You can use your Medisave savings to pay for your own or your dependents’ medical expenses, such as hospitalization, surgery, outpatient treatment, and approved insurance premiums. You can also use your Medisave savings to pay for long-term care services under the ElderShield and CareShield Life schemes.

Have an Article to Suggest?

Tropika Club is always looking for new and exciting content to feature in their magazine and they value the input of our readers. If you have any noteworthy content or articles that you believe would be a great addition to Tropika Club’s magazine, we are open to suggestions and encourage you to reach out to us via email at [email protected]. By doing so, Tropika Club values your expertise and knowledge in the matter and appreciates your willingness to help. We will review your recommendations and update our list accordingly

Meanwhile, Check Out Tropika Club’s Ecosystem of Websites

Tropika Club Magazine – Tropika Club Magazine is a Singapore-based publication that features articles on a wide range of topics with a focus on local businesses and content for the region. The magazine emphasizes supporting local businesses through its #SupportLocal initiative, which includes coverage of everything from neighborhood hawker stalls to aesthetic clinics in town. In addition to highlighting local businesses, Tropika Club Magazine also covers a variety of local content, including beauty, lifestyle, places, eats, and what’s on in Singapore and the Asia Pacific region.